|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

|

|

|

Mortgage Lenders in South Dakota: Navigating Your OptionsUnderstanding the Mortgage Landscape in South DakotaSouth Dakota offers a diverse range of mortgage options tailored to suit the needs of its residents. Whether you're a first-time homebuyer or looking to refinance, understanding the available lenders can significantly impact your financial future. Types of Mortgages AvailableIn South Dakota, homebuyers can choose from various types of mortgages. Each type has distinct advantages depending on your financial situation.

For more information on FHA loans in other states, you can explore fha loan oregon. Top Mortgage Lenders in South DakotaLocal LendersLocal lenders often provide personalized service and are familiar with the South Dakota market, which can be beneficial in navigating the home buying process.

National Lenders with South Dakota PresenceNational lenders also offer robust services in South Dakota, combining local knowledge with extensive resources.

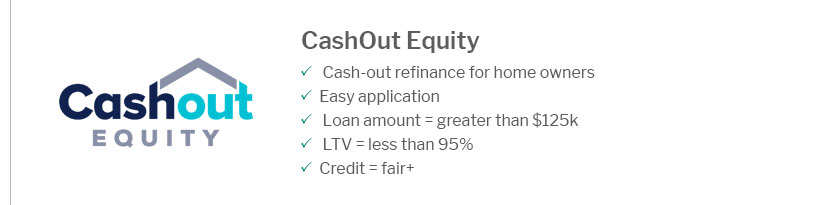

Refinancing Options in South DakotaRefinancing your mortgage can be an excellent way to reduce monthly payments or change loan terms to better suit your financial goals. Keeping up with current refinance mortgage rates md can provide insights into potential savings and opportunities for reducing your mortgage burden. FAQ: Common Questions About South Dakota MortgagesWhat credit score is needed for a mortgage in South Dakota?While the minimum credit score can vary by lender, most require at least a 620 for conventional loans. FHA loans often allow scores as low as 580. How much down payment is typically required?For conventional loans, the standard down payment is usually 20%, but some lenders offer options as low as 3% for qualified buyers. FHA loans may require as little as 3.5% down. Are there any special programs for first-time homebuyers?Yes, South Dakota Housing Development Authority offers programs that provide down payment assistance and lower interest rates for first-time homebuyers. https://www.zillow.com/lender-directory/sd/

Looking for a lender? - RELIABANK DAKOTABlaine FopmaNMLS# 897132 - Plains Commerce BankShawna KleinwolterinkNMLS# 773405 - First International Bank & TrustBrent ... https://www.sdhousing.org/ready-to-buy/find-a-lender

Find a Participating Lender ; American Bank & Trust, Alpena - American Bank & Trust - Alpena ; American Bank & Trust, Carthage - American Bank & Trust - Carthage. https://money.usnews.com/loans/mortgages/state/south-dakota-mortgage-lenders

US News selects the Best Loan Companies by evaluating affordability, borrower eligibility criteria and customer service.

|

|---|